Pretax margin formula

A decreasing Pretax Margin is usually a negative sign showing the company has not been able to keep its operations costs low while generating earnings. Net Sales Pretax Margin.

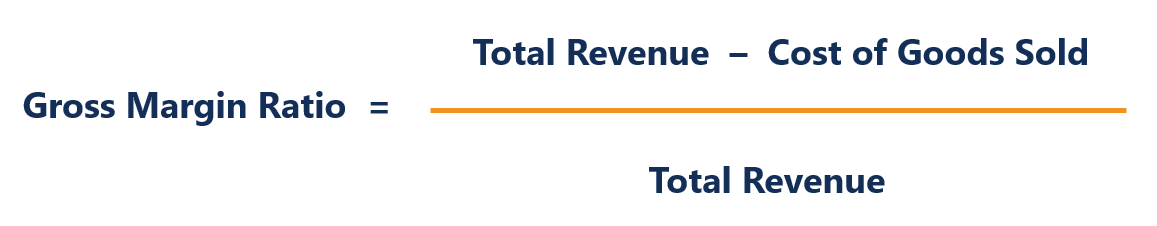

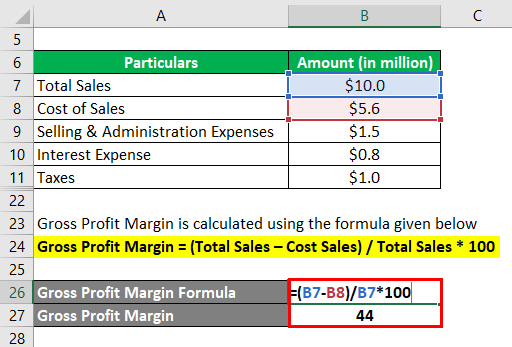

Gross Margin Ratio Learn How To Calculate Gross Margin Ratio

Formula Systems 1985 Pretax Margin as of today August 25 2022 is 1487.

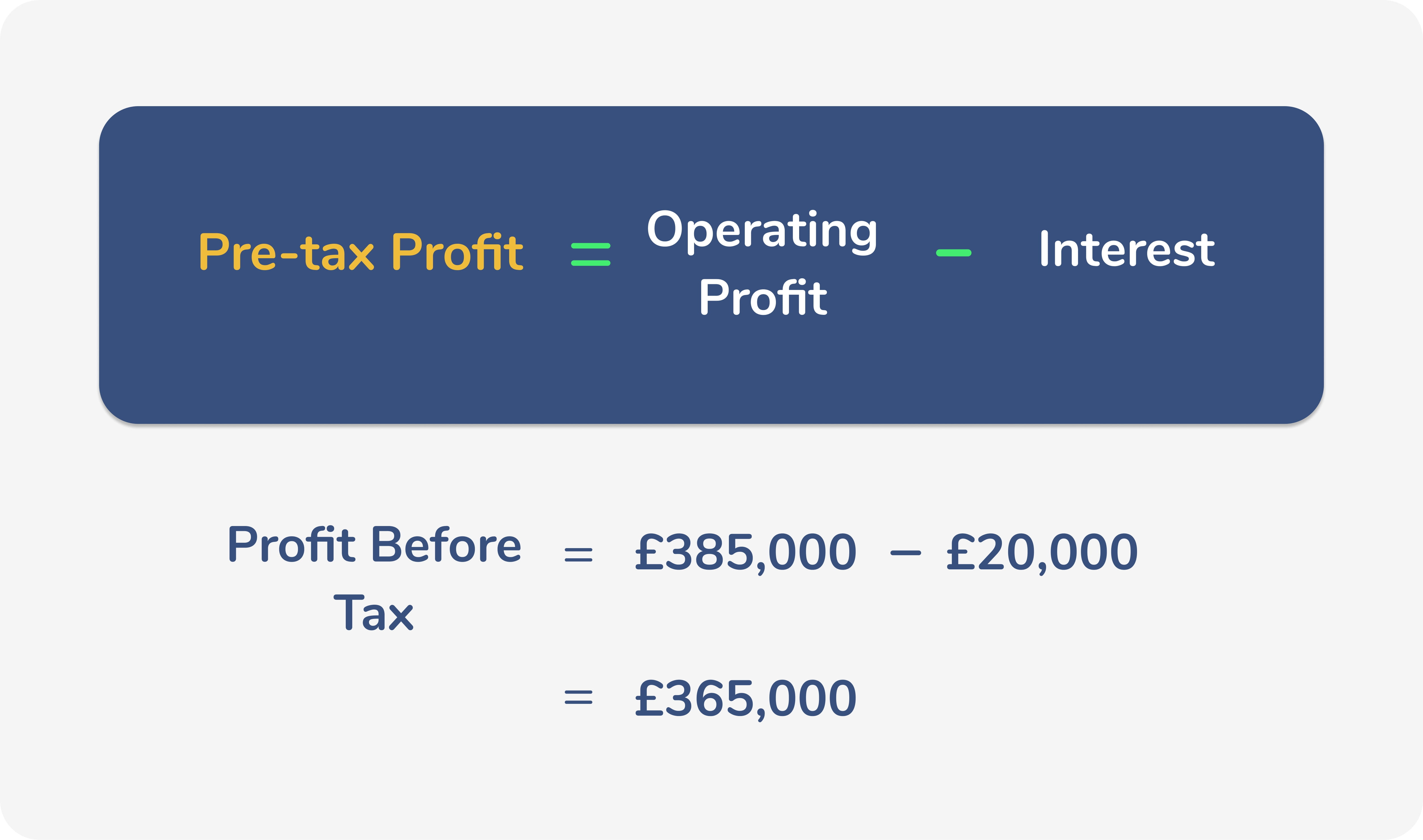

. Where PP Pretax Profit. The pre-tax profit margin can be calculated by dividing the EBT by revenue. The higher the pretax profit margin the more profitable the company.

In depth view into STUFSY Pretax Margin explanation calculation historical data and more. Pretax Income 8000000 560000 86000 12000 240000 130000. The Pretax Margin measures how well a company can generate.

An accounting term that refers to the difference between a companys operating revenues from its primary businesses and its direct expenses. Pretax profit margin formula. Pretax Profit Margin PP S.

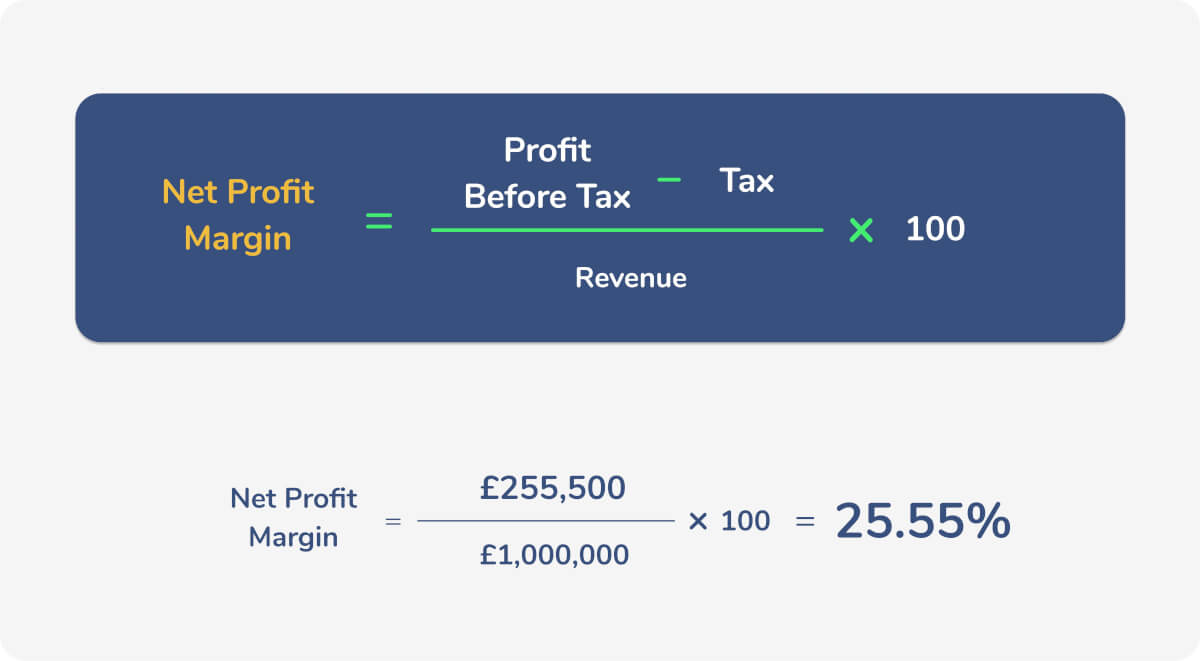

Equation for calculate pretax profit margin is Pretax Profit Margin PP S. Net Earnings Income Tax. Income Before Taxes divided by Revenue multiplied by 100.

If Pretax Margin stays the same over. Pretax profit margin is a companys earnings before tax as a percentage of total sales or revenues. The pretax margin as know as pretax profit margin is widely used to measure the operating efficiency of a company before deducting taxes.

The page shows here the pretax profit margin formula to calculate the pretax profit margin of a company. Pre-Tax Margin 25 million 100 million 25. Pre-Tax Income 30 million 5 million 25 million.

Get Your 7-Day Free Trial. Where PP Pretax Profit. Using the formula above the pretax income of Company ABC is calculated as.

Pretax Operating Income - PTOI. S Net Sales. The pretax profit margin formula.

To calculate the pre-tax profit margin divide the pretax-profit by the net sales. S Net Sales. The pre-tax margin formula is calculated by dividing a companys earnings before taxes EBT by its revenue.

In other words you take the gross revenue. Explanation of Pretax Margin. Pre-Tax Profit Margin Earnings Before Taxes EBT.

Take operating income and subtract interest expense while adding any interest income adjusted for non-recurring items like gains or losses. The pretax profit margin is calculated by the formula.

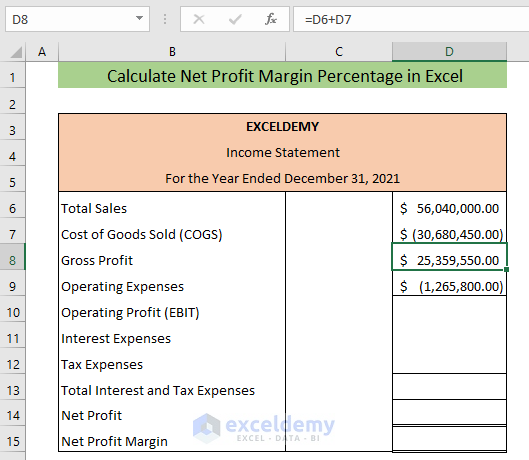

How To Calculate Net Profit Margin Percentage In Excel Exceldemy

Read This How To Piece That Explains How You Can Use Conditional Formatting Combined With The Or Function To Evaluate T Colorful Backgrounds Discover Solving

Profit Margin The 4 Types Formula And Definition Wise Formerly Transferwise

Pretax Profit Margin Formula Meaning Example And Interpretation

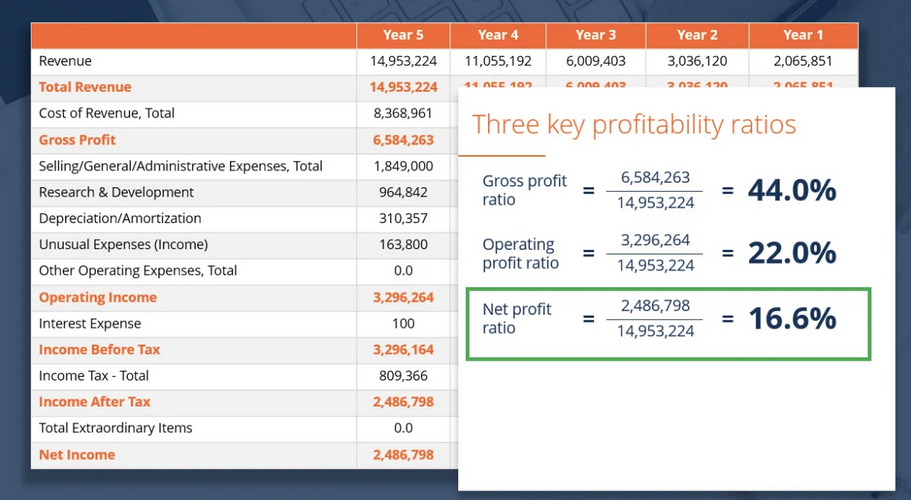

Guide To Profit Margin How To Calculate Profit Margins With Examples

Pin By Allan Goh On Computer Cost Accounting Cost Accounting

Profit Margin The 4 Types Formula And Definition Wise Formerly Transferwise

Formula For Net Profit Margin In 2022 Net Profit Net Income Profit

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Pre Tax Profit Margin Formula And Ratio Calculator Excel Template

Profit Margin L Most Important Metric For Financial Analysis

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

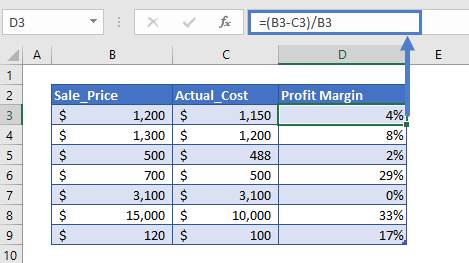

Profit Margin Calculator In Excel Google Sheets Automate Excel

Net Profit Margin Formula And Ratio Calculator Excel Template

Profit Margin Formula And Ratio Calculator Excel Template

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Accounting And Finance Finance Investing